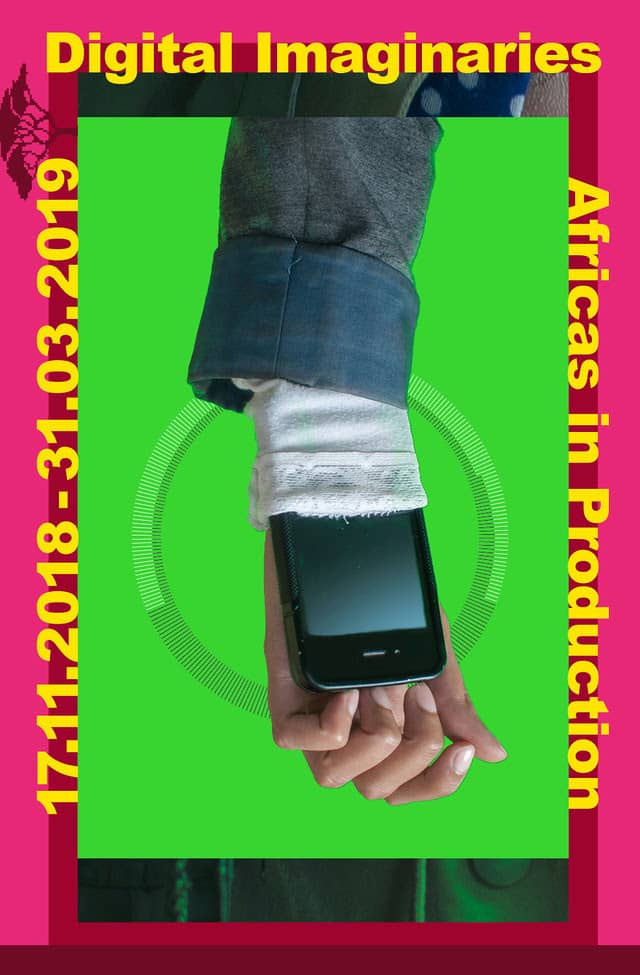

The Art Market 2021 reveals market shifts during a year of exceptional challenges with extraordinary growth of online sales

The fifth edition of The Art Basel and UBS Global Art Market Report is now available. Written by renowned cultural economist Dr. Clare McAndrew, founder of Arts Economics, and published by Art Basel and UBS, The Art Market 2021 presents the results of a comprehensive and macro-level analysis of the global art market in 2020, including a survey examining the behaviors of high net worth (HNW) collectors, conducted by Arts Economics and UBS Investor Watch. The report looks at the effects of the global pandemic on various sectors of the art market last year, and how its dynamics have evolved during a difficult and transformative year. It also reviews some of the biggest trends that will shape the market in 2021 and beyond. The full report is free to download on the Art Basel and UBS websites.

Key findings of The Art Basel and UBS Global Art Market Report include:

• Global Sales: Global sales of art and antiques reached an estimated $50.1 billion, down 22% from 2019. Online sales of art and antiques reached a record high of $12.4 billion, doubling in value on the previous year and accounting for a record share of 25% of the market’s value.

• Leading Markets: The three major art hubs – the US, the UK, and Greater China – continued to account for a majority (82%) of the value of global sales in 2020. The US market retained its leading position, with a share of 42% of global sales values, with Greater China and the UK on par at 20%.

– Sales in the US art market fell by 24% in 2020 to $21.3 billion – its biggest fall in sales since 2009 – but remained 76% above their level in 2009.

– Sales in Greater China decreased by 12% in 2020 to $10 billion, the third year of declining sales, although this drop-off was less severe than that of its other major peers.

– Sales in the UK declined by 22% in 2020 to $9.9 billion, their lowest level in a decade, but still 10% above the previous recession in 2009.

• Dealer Figures: The fallout from the COVID-19 crisis led to a 20% decline in aggregate dealer sales to an estimated $29.3 billion in 2020, after a marginal increase of 2% in 2019, with dealers in different regions and value segments faring very differently. The ability to reduce major operating costs allowed some dealers to maintain profitability in 2020 in the face of declining sales; 28% reported being more profitable than in 2019, with a further 18% maintaining a stable level of net profit. 58% of dealers surveyed expected an improvement in sales in 2021, including 16% predicting a significant improvement.

Client relationships, online sales, and art fairs were their top priorities looking ahead to 2021.

• Auction Figures: Public auction sales reached $17.6 billion in 2020, a 30% decline from 2019, while private auction sales were estimated to have reached over $3.2 billion in 2020 (up 36% from 2019). Greater China, the US, and the UK remained the three largest auction market hubs, with a combined share of 81% of global sales by value. Greater China overtook the US as the largest global market for public auction sales with a share of 36% of sales by value, while the US’ share fell to 29%. 2020 saw declines in both the value and volume of works sold across all price segments of the fine art auction market. Sales fell consistently across the board as the number of live auctions diminished and businesses were forced to close for periods of the year. In the fine art auction sector, 22% of the lots sold in 2020 were in online-only sales, double the share in 2019; sales priced over $1 million made up only 6% of total online-only values, versus 58% for offline sales.

• Art Fairs: An analysis on 365 global art fairs in 2020 revealed 61% were cancelled, 37% held live events, and the remaining 2% of fairs held hybrid, alternative events. The significant reduction of live events in 2020 led the share of sales from live art fairs to decline to just 13% of dealers’ total sales, with an additional 9% made through art fair online viewing rooms (OVRs). 41% of HNW collectors surveyed made a purchase at an art fair in 2020, while 45% reported making one through an art fair’s OVRs. According to a survey of art fairs in 2020, works with visible prices generated 92% of enquiries on their OVRs overall, demonstrating the importance of price transparency in engaging collectors; the majority (72%) of HNW collectors surveyed also felt it was important or essential to have a price posted when they were browsing works of art for sale online. Just under half (48%) of the HNW collectors surveyed said they would be willing to go to an art fair in the first six months of 2021, although 64% would only be ready to attend local events. The majority of collectors (68%) reported that they would be happy to attend a fair by the end of Q3 2021, and over 80% into Q4.

• Online Sales:

Despite the contraction of sales overall, aggregate online sales reached a record high of $12.4 billion, doubling in value from 2019. The share accounted for by online sales also expanded from 9% of total sales by value in 2019 to 25% in 2020, the first time the share of e-commerce in the art market has exceeded that of general retail. HNW collectors most commonly purchased art online from online auctions, while gallery and art fair OVRs were the second and third most popular platform for collectors overall. The share of online sales in the dealer sector (including art fair OVRs) rose from 13% in 2019 to 39% in 2020, although dealers noted that the majority of their online sales were to established clients. Dealers at all levels showed significant increases in the online component of their sales, with those at the high end showing the greatest annual increases (up 47% in the $10 million-plus turnover segment). Social media continued to be a key channel used by the art market to try to reach new audiences and generate sales, and roughly one third of collectors purchased art using Instagram in 2020. Around 90% of all HNW collectors surveyed had visited a gallery or art fair OVR during the year.

• Global Wealth and HNW Collectors: Surveys of 2,569 HNW collectors conducted by Arts Economics and UBS Investor Watch in ten markets indicated active engagement in the art market despite the pandemic. Unlike some previous recessions, there was a heightened awareness and strong drive by some collectors to support the arts last year, and 66% of the HNW collectors surveyed felt the pandemic had increased their interest in collecting, including nearly one third (32%) that reported it had significantly done so. 81% had bought art via a gallery in 2020, which was also their most preferred channel for purchasing art. Millennial collectors were the highest spenders in 2020, with a median expenditure of $228,000 and 30% having spent over $1 million (versus 17% of Boomers). Female collectors spent more than their male counterparts in 2020, with their median expenditure rising by 13% year-on-year. Across all markets, 46% of collectors focused only on galleries they had bought from before in 2020, while a significant share (41%) also only bought works of artists familiar to them. HNW collectors will be active in the market in 2021, with the majority (57%) planning to purchase more works for their collections.

• Economic Impact: The art market directly employed an estimated 2.9 million people in 2020 and comprised approximately 305,250 businesses, with aggregate employment losses estimated at 4% year-on-year. Ancillary expenditures fell by 16% in 2020 to $16.6 billion, in line with cost-cutting measures and restrictions of travel, events, and hospitality. The transformation of businesses online diverted more resources to IT, with spending in this area up by close to 80% year-on-year reaching $3.5 billion, making it the highest area of ancillary spending in 2020 (versus art fairs in 2019).

Clare McAndrew, Founder, Arts Economics said: ‘The art market was uniquely placed to struggle with the realities of the COVID-19 pandemic in 2020 as it is populated by mainly small businesses that rely on discretionary purchasing, travel and personal contact. The fall in sales was inevitable. But the crisis also provided the impetus for change and restructuring, the most fundamental shift being the rollout of digital strategies and online sales, which had lagged behind other industries up to now. The art trade showed incredible resilience in how it adapted to some of the new realities, and although businesses are still figuring out how to balance the new more online-based market with the shared experience and excitement of offline sales and events, few see these shifts as transient. One of the most worrying impacts of the pandemic will be its effects on employment, and this economic fallout is likely to extend well into 2021.’

Noah Horowitz, Director Americas, Art Basel said: ‘The findings from Clare McAndrew’s latest annual report are critical – not only in terms of the insights they provide into one of the most unusual and challenging years the global art market has ever endured, but also in regards to what they portend for the future of our industry. While the market contracted sharply across all sectors in 2020, with declines in both value and volume of sales for dealers and auction houses alike, the resilient interest in collecting throughout it all was profound, as the year also marked a transformative period of innovation, restructuring, and new consumer behaviors, especially online—all of which have the potential to significantly redefine the shape of the art business in the coming period.’

Christl Novakovic, CEO UBS Europe SE and Head Wealth Management Europe and Chair of The UBS Art Board said: ‘The year 2020 marked a turning point for digital innovation in the art market. The shift to online platforms enabled collecting, increased transparency, and bolstered the market even when national lockdowns forced gallery, live auction, and museum closures. The pandemic proved that we need art to lift our gaze above hardship, to express our views and emotions, and to find levity in trying times. Collectors remained passionately engaged during the hardest moments and devoted to collecting with purpose and a long-term plan.’

Please click here to access The Art Basel and UBS Global Art Market Report.