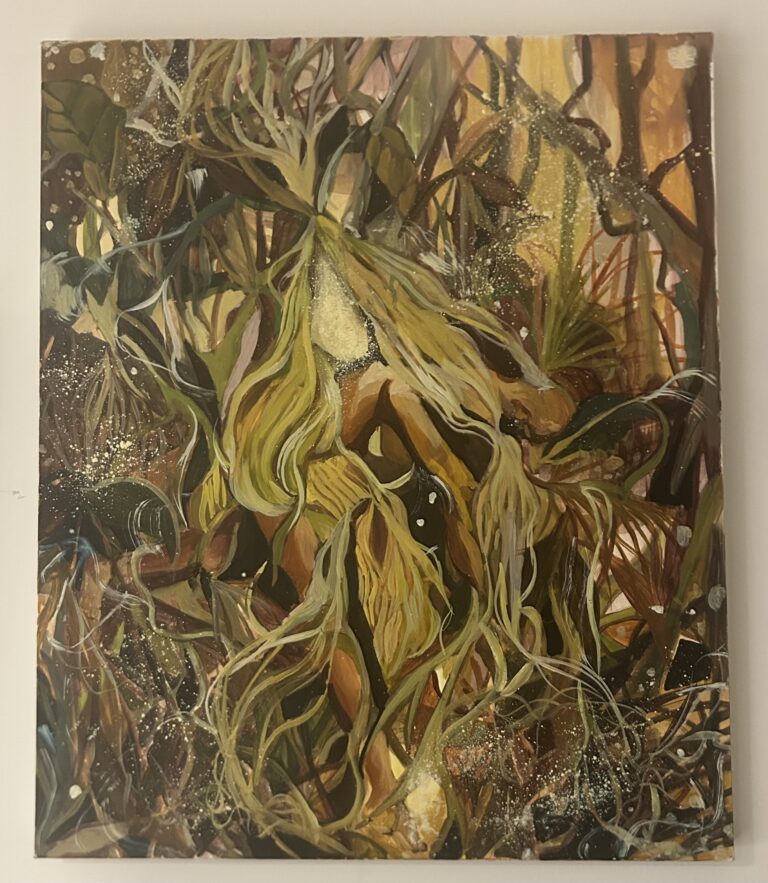

Above: Manzel Bowman Place from Within.

As bitcoin-revolution.app suggests, cryptocurrency is a booming industry with lots of potential. Most people only know about Bitcoin through what they heard a few years ago when it was first getting popular – this means they don’t realize how it could be used in the art industry to keep it up-to-date with today’s modern world. One is a US$60 billion global market. The other has a global market cap of US$68 billion as of writing this. One is creative and still primarily analog, the other was born digital and resides virtually. The global Art market is an old world industry, while Blockchain, the technology behind the digital currency Bitcoin, is fuelling a shift and rise of a whole new world.

What these two disparate worlds have in common now, that, there are some people and businesses seeking to make the best of both, merge, to help make the business of global art more transparent, secure and easier for buyers and sellers. And while the general benefits of that move are clear, even at this nascent stage, the effect will be without question disruptive to the Art industry’s status quo.

You see, while the Art world is warming up to the potential of crypto currencies, partly because of Blockchain’s ability to deal with issues of provenance, copyright and authentication of artwork – with those problems potentially solved – it means the reduction and reliance on brokers and other middlemen.

Fact is, the shift is happening and the early adopters and first movers are going ahead with what they believe is a great opportunity to solve the art market’s greatest challenge – the lack of transparency.

In what is often referred to as the last unregulated market, what has prevailed is a paper-based culture of art transactions, operating on trust alone. But this trust keeps being tested, as theft and forgery scandals have been rife. Added to that, there is resistance from the old guard – such as old auction houses like Christie’s and Sotheby’s that have controlled the art market for centuries. They still rely on those paper certificates and receipts which can easily be lost, tampered with or stolen, even though some members of the old guard in their resistance to technology solving this. They are still insisting that establishing the authenticity of works of art which is critical to their defined value still needs to be done by skilled professionals. In other words, no technology interference needed here.

But there are other market players who beg to differ.

In walks a nimble-minded established brand like Luxembourg-based Deloitte, with ArtTracktive. Though they are a brand known for their financial pedigree, they have developed a tech-driven alternative to the paper trail that normally proves the provenance and movements of a piece of artwork. The firm’s blockchain development team showcased the application during the Tech event in Luxembourg four months ago.

They describe ArtTracktive, as an application that provides a distributed ledger for tracking the provenance and whereabouts of fine artworks. The blockchain-based application manages the interactions between all parties involved, from the artist or the owner of the piece of art, via freight forwarders, customs, art galleries, museums and all the way to potential buyers.

So in other words, the blockchain distributed ledger can trace the journey of artworks, making all events in the life cycle of an artwork are recorded and traceable in the Art market. And with TEFAF 2016 Art Market Report, showing that the number of art transactions in the world now reaching 38.1 million, it’s a huge and lucrative problem that ArtTracktive seeks to solve.

Blockchain – both brilliant and scary

The thing that is both scary and brilliant about blockchain technology and cryptocurrencies like Bitcoin, is how it works and who and what it doesn’t need.

According to Wikepedia – A blockchain essentially acts as a public database on which transactions are permanently recorded. It is highly secure. So when a transaction occurs, instead of being recorded on a single, centralized ledger, it instantly appears on a vast network of computers. Although public, it can only be used with a specific “key”. When accessed, an immutable trail is left behind. In other words, blockchain technology eliminates the need for a trusted third party to verify that a transaction has taken place. There is no centralized body – like a bank head office.

So you can see why the current power holders in the Global Art Market may resist and why others seeking to evolve and integrate new ways and things will love it, will love that Blockchain and Bitcoin exists. So for the future, if you’re wanting to purchase some digital or even physical artworks, you may perhaps also want to find a great way to buy bitcoin alongside, so you’re actually able to purchase the artwork you have your eyes on! When purchasing your bitcoin, be sure to do some research beforehand to make sure you’ve found the best value. If you’re unsure how to do this, there are websites like https://aboutbitcoin.io/ that can offer useful reviews to ensure you get the best bitcoin rates. That way, you can purchase the best artwork! Cryptocurrencies are proving to be a spectacular investment for many financially savvy individuals online. People who may be inclined to consider the potential of Bitcoin may also be attracted to online stock trading in which they could make a good return on their investments. The ability to follow activity in the value of the various cryptocurrencies transfers well to keeping a close eye on the stock market and which companies could become gold mines for their investors.

In fact, other early movements of using Blockchain technology and Bitcoin digital currency in the global art market has been seen on the payments side. Already, some artists are giving accepting bitcoins for their artwork, especially digital art. Additionally, In April 2015, the Austrian Museum of Applied Art/Contemporary Art (MAK) became the first museum in the world to buy a work of art using Bitcoin.

Regardless of where you may sit in the food chain of the Global Art Market-without question Blockchain and digital currencies like Bitcoin are already irrevocably changing the way the industry does business. Everyone now gets to decide on which side of history they will sit.